Venture capital this week: fewer rounds, bigger checks 1 13 2026 after SpaceX IPO Announcement

Venture capital is entering 2026 in a highly polarized state: fewer rounds, much larger checks, and an intense focus on AI, deep tech, healthcare, and space, with SpaceX sitting at the center of the narrative as both a product powerhouse and the most consequential prospective IPO in the market. The combination of fresh mega‑funds, strong early‑January deal flow, and the looming SpaceX listing is already shaping how founders, GPs, and LPs are thinking about risk, stage, and sector exposure in the first weeks of the year.reuters+8

Venture capital this week: fewer rounds, bigger checks

Weekly funding statistics covering the period around January 6–12, 2026 show a classic “fat‑tail” pattern: the number of announced rounds fell, but total capital raised jumped sharply thanks to a small set of outsized deals.parsers.substack+1

-

One venture analytics newsletter reports 28 funding rounds, down about 25% from the prior week, yet total capital raised climbed to roughly $3.44 billion, more than doubling week‑on‑week.parsers.substack

-

Geographic distribution is uneven:

-

The United States logged 8 funding rounds totaling about $132 million in that specific dataset, in smaller SaaS, AI, healthcare, and niche consumer verticals.parsers.substack

-

The United Kingdom recorded 3 rounds totaling approximately $1.35 billion, heavily skewed by a $1 billion round for Kraken Technologies, an energy‑tech platform valued at around $8.65 billion, plus substantial financings for Motorway and Octopus Energy US.parsers.substack

-

India saw multiple rounds including Knight FinTech and Limelight Diamonds, together adding tens of millions of dollars to the week’s global totals.parsers.substack

-

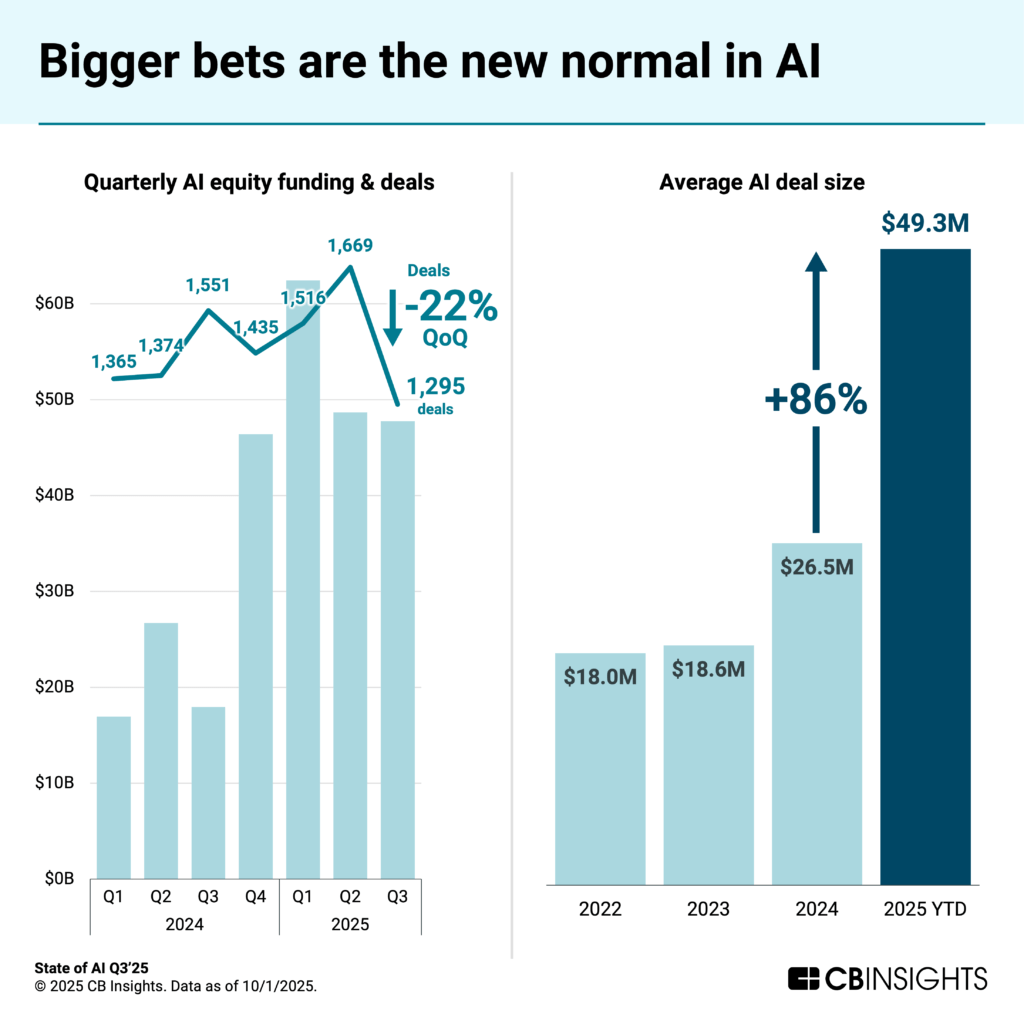

Outside that specific slice, other datasets tracking the “biggest funding rounds” globally show that the first full week of 2026 included a $20 billion fundraise for Elon Musk’s AI company xAI and several other $100M+ financings across AI, biotech, and infrastructure. Analysts emphasize that while the count of deals is not especially high by historical standards, the average and median deal sizes in certain sectors have risen substantially, reflecting a willingness to commit large amounts of capital to perceived future category leaders.intellizence+2

Sector‑wise, three themes dominate early January VC news:

-

AI and infrastructure: xAI’s $20B raise dwarfs most other rounds and signals that the late‑stage AI funding wave is still in full swing, even as investors become more selective.news.crunchbase+1

-

Healthcare and life sciences: a healthcare venture markets report notes that venture capital in the space is regaining momentum, with projections of $65–$70 billion in healthcare venture investment in 2026 as IPO and M&A conditions improve.morningstar

-

Energy and climate: large tickets into UK energy‑tech and clean‑energy platforms such as Kraken and Octopus Energy suggest that investors continue to treat decarbonization, grid software, and energy retail as long‑duration, defensible themes.wellington+1

On the capital‑supply side, major venture firms are rearming:

-

Andreessen Horowitz has reportedly raised around $15 billion for new funds, nearly $7 billion of which is intended for growth‑stage investments in areas like infrastructure and defense, giving the firm capacity to anchor large late‑stage rounds in precisely the sectors that are now in favor.cnbc

-

Commentaries on the 2026 venture outlook describe a “barbell” structure: mega‑funds capable of writing $100M+ checks at one end, and small specialist funds at the other, with mid‑sized generalist funds facing the toughest environment.saastr+1

Near‑term outlook: how next week is likely to evolve

Venture outlook pieces written for the turn of the year describe a 2026 environment characterized by more rational valuations than the 2021 peak, but with a still‑healthy appetite for high‑conviction bets where the path to significant scale is credible. Several specific expectations for the coming weeks emerge from these analyses and from early‑January deal data.intellizence+2

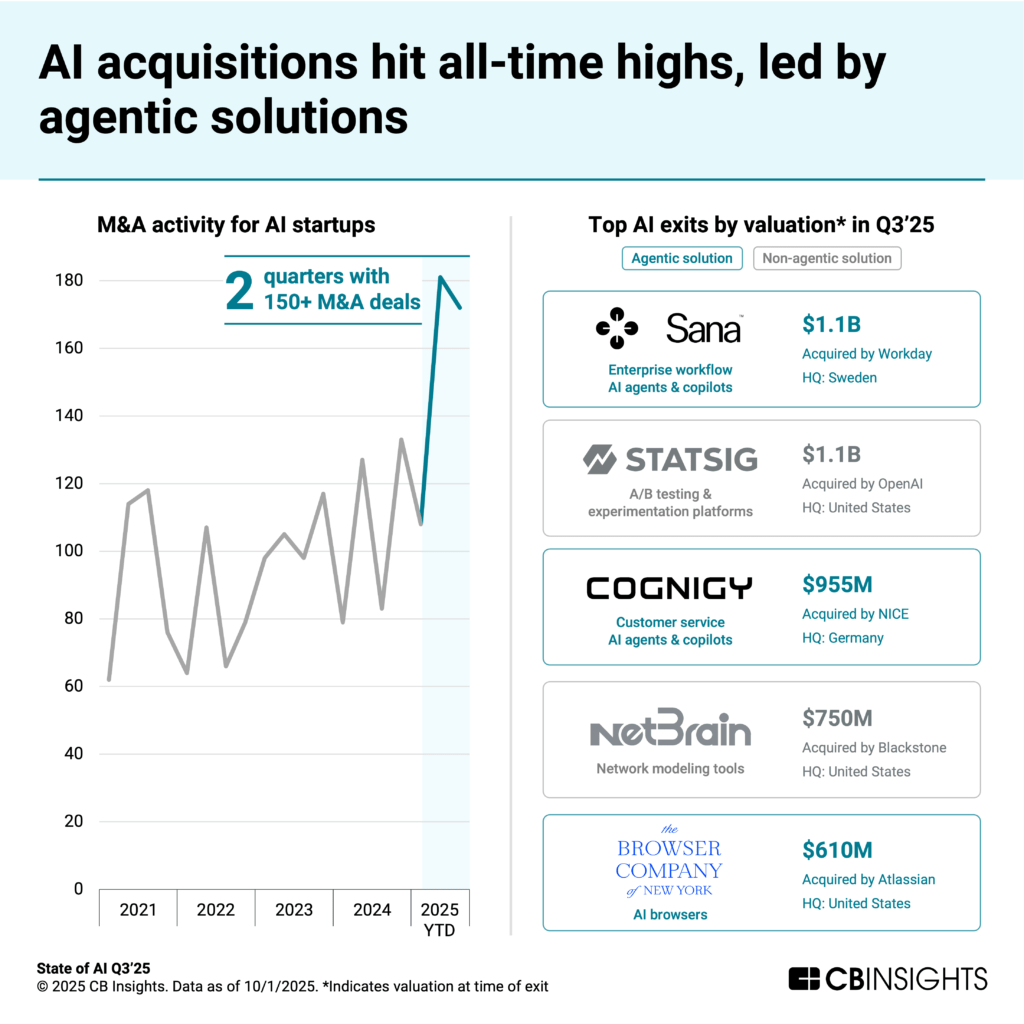

First, IPO and M&A windows are gradually reopening. A 2026 VC outlook notes that deal volume toward the end of 2025 was up roughly 40% year‑over‑year, driven by strategic acquisitions and a modest revival in tech IPOs, setting the stage for more exits this year if inflation and interest‑rate trends remain favorable. As a result, venture investors are increasingly positioning portfolio companies for potential offerings or sale processes, especially those in AI, infrastructure, and healthcare that can show compelling growth and improving unit economics.wellington+1

Second, capital will likely remain concentrated. Weekly “top deals” roundups highlight the pattern: a handful of enormous financings in AI, biotech, and infrastructure dominate the charts, with more modest but still meaningful activity in fintech, consumer, and vertical SaaS. Given that trend, it is reasonable to expect that in the next week and the rest of January:news.crunchbase+1

-

Additional large AI infrastructure or model‑company financings will be announced as late‑stage funds deploy fresh capital to secure stakes in perceived future platform companies.intellizence+2

-

Healthcare and life‑science rounds will remain frequent, particularly for platforms and tools that can ride the renewed IPO window and serve as acquisition targets for larger pharma and medtech incumbents.morningstar+2

-

More secondary transactions and structured deals will emerge as investors seek partial liquidity from mature private holdings while keeping upside if a robust IPO or acquisition materializes later in the cycle.vntr+1

Finally, macro‑level venture commentary suggests that manager selection and access will matter more than ever. With returns increasingly driven by a small set of outlier outcomes in sectors like AI, space, and defense, LPs are expected to push harder on questions such as: “Do you have meaningful exposure to the next generation of SpaceX, Starlink, Anthropic, or Starship‑adjacent plays?”saastr+2

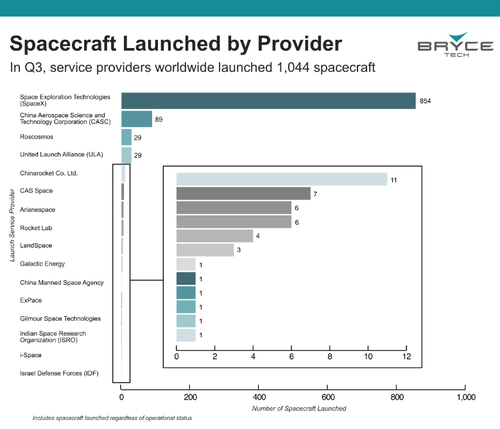

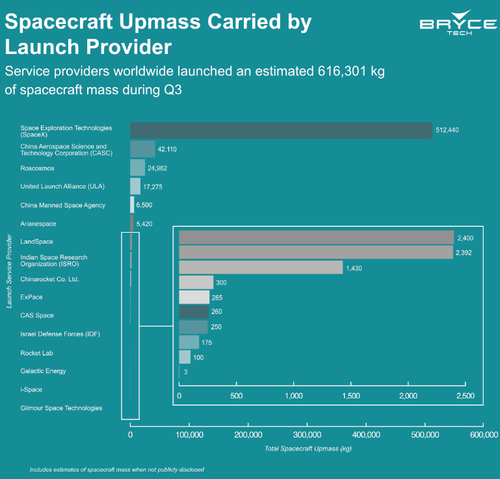

SpaceX product and business news: Starlink, Starship, and new infrastructure

SpaceX is not just a financing story; it is actively shipping products and evolving its infrastructure in ways that matter for both revenue and perception of long‑term value.

On the Starlink side, recent regulatory and technical developments significantly expand the platform’s capabilities:

-

In early January 2026, the US Federal Communications Commission (FCC) granted SpaceX permission to expand and upgrade the second‑generation Starlink constellation, raising the approved satellite count for Gen2 from 7,500 to 15,000, and allowing the company to operate up to about 19,400 satellites when combined with its first‑generation approvals.pcmag

-

The same ruling authorizes SpaceX to operate many of these satellites at lower orbits—roughly 340–485 km for portions of the constellation—reducing latency, and grants a time‑limited waiver to exceed certain power‑flux limits in order to deliver symmetrical gigabit‑class speeds to customers.pcmag

-

SpaceX plans to use this regulatory clearance to roll out “V3” Starlink satellites, larger and more capable spacecraft designed to provide significantly higher capacity. The company intends to deploy many of these new satellites using its fully reusable Starship launch system, although initial launches may rely on existing Falcon rockets until Starship operations are fully commercial.pcmag

SpaceX itself already reports that Starlink’s current network delivers download speeds of roughly 200 Mbps in many regions, and the expanded constellation plus higher‑power operations are meant to transform Starlink into a globally competitive broadband alternative for fixed and mobile users, including direct‑to‑device services.pcmag

Beyond connectivity, SpaceX is actively evolving its launch and exploration capabilities:

-

The company’s Starship vehicle—billed as the world’s most powerful rocket—is designed to carry up to 150 metric tons in fully reusable mode and up to 250 metric tons in expendable mode, with a payload compartment larger than any existing fairing.spacex

-

Starship’s mission scope includes delivering large constellations of satellites, massive space telescopes, cargo, and crews to Earth orbit, the Moon, Mars, and beyond, and it has been selected by NASA as the lunar lander for parts of the Artemis program.spacex+2

-

After a series of high‑profile test failures, Starship achieved a fully successful test flight on October 13, 2025, demonstrating the viability of its super‑heavy lift capabilities and reinforcing the view that superheavy‑lift rockets can transform astronomy and deep‑space infrastructure by allowing much larger, more capable payloads to be flown per launch.ien+1

Recent company updates also describe initiatives to evolve multi‑user spaceports, improve reusability across the Falcon and Starship fleets, and advance Starlink Direct to Cell offerings, which aim to connect standard mobile devices directly to satellites without specialized hardware. These product and infrastructure developments underpin projections that SpaceX’s revenue—expected by some estimates to reach around $15 billion in 2025 and $22–$24 billion in 2026, primarily driven by Starlink—will continue to grow rapidly.spacex+1

SpaceX IPO plans and venture exit dynamics

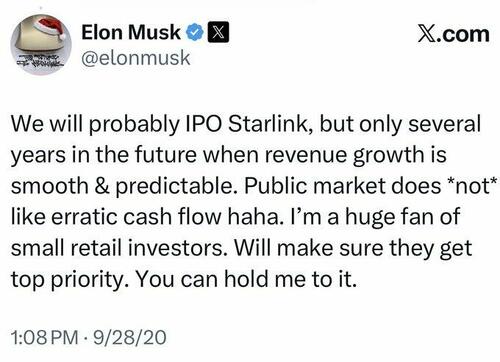

On the capital‑markets front, multiple reports now indicate that SpaceX is actively preparing a 2026 initial public offering that could be historic in both size and valuation.sidekickmoney+3

-

A Reuters report from December 2025 cites sources indicating that SpaceX is targeting a 2026 IPO that would raise more than $25 billion, with some analyses from other outlets suggesting the raise could exceed $30 billion.bloomberg+2

-

Valuation scenarios for the IPO commonly cluster around $1–1.5 trillion, with some commentary framing SpaceX as a candidate to become the first venture‑backed company to list at or above a $1 trillion market capitalization; for context, only Saudi Aramco has previously listed at a $1 trillion‑plus valuation.ainvest+4

-

Bloomberg‑linked analysis reported by Reuters notes that SpaceX may use the IPO proceeds to build space‑based data centers, including purchasing high‑performance chips to run them, effectively tying together the company’s expertise in launch, Starlink connectivity, and compute infrastructure.reuters+1

SpaceX has also been engaged in private secondary share sales. One such transaction reportedly valued the company at around $800 billion, although Elon Musk publicly dismissed some of these valuation reports as inaccurate. Regardless, the direction of travel is clear: SpaceX is one of the most valuable private companies in the world, and a public listing in 2026 would be a watershed event for venture‑backed exit markets.finance.yahoo+5

Analyses of the prospective IPO highlight several implications:

-

Liquidity and recycling of capital: A SpaceX IPO at or near a trillion‑dollar valuation would produce massive liquidity for early investors and employees, freeing up capital to be recycled into new funds, growth vehicles, and co‑investments, and demonstrating that venture‑scale capital can still culminate in public‑market realizations.bloomberg+2

-

Benchmark for deep tech and space: SpaceX’s listing would set a valuation and revenue benchmark for other space and deep‑tech companies, potentially lifting comps for launch startups, satellite operators, in‑orbit servicing companies, and related dual‑use defense technologies, much as earlier landmark IPOs did for consumer internet and SaaS.ien+3

-

Market absorption and concentration risk: Commentators warn that a single IPO of this size will test public‑market appetite for highly capital‑intensive, long‑duration stories and that if only a small handful of such companies go public at extreme valuations, venture returns may become more concentrated than ever in a few names.vntr+2

At least one detailed venture analysis frames the SpaceX IPO as a “$1.5 trillion question,” arguing that if a couple of ultra‑large outcomes like SpaceX’s listing and a few AI or infrastructure giants come to market successfully, they could validate the entire thesis behind mega‑growth funds and long‑held private stakes. The same analysis notes that such outcomes would also raise the bar for what LPs expect from large funds in terms of access to these rare assets.saastr+1

How SpaceX is reshaping the funding landscape

Taken together, SpaceX’s product trajectory (Starlink expansion, Starship maturation, new infrastructure like space‑based data centers) and its IPO plans are already changing how venture capital is allocated and how exits are imagined.

Several shifts are already visible or widely anticipated:

-

Capital rotation into capital‑intensive deep tech: The prospect of a trillion‑dollar‑plus space and connectivity company listing successfully encourages investors to allocate more to capital‑hungry verticals like launch systems, satellite networks, in‑orbit operations, defense, and AI compute infrastructure, on the assumption that public markets will reward scale and technological moats in these domains.ainvest+4

-

Upsizing of late‑stage funds: Managers like a16z and others raising multibillion‑dollar growth vehicles are doing so in an environment where a single late‑stage position in a company of SpaceX’s profile can drive a fund’s performance. This dynamic contributes to the barbell effect: very large funds compete for allocations to perceived “future SpaceXs,” while small, specialized funds aim to find differentiated niches earlier in the lifecycle.cnbc+3

-

Greater emphasis on infrastructure plays: SpaceX’s plans to use IPO proceeds to build space‑based data centers, leveraging Starlink and high‑performance chips, underscore a broader pattern where infrastructure—both physical and digital—is becoming a favored target for large checks. Venture investors are extrapolating from this model to back other integrated infrastructure plays spanning connectivity, compute, and data.sidekickmoney+3

-

Tightening linkage between product milestones and financing: The successful October 2025 Starship test and ongoing Starlink upgrades are not just engineering achievements; they are milestones that make a public listing more credible and create a clearer narrative for investors about future growth and cash‑flow potential. This reinforces the importance of visible technical and commercial progress for other deep‑tech companies looking to follow a similar path.spacex+4

In the near term, as January unfolds, venture participants can expect discussions around SpaceX—its Starship tests, Starlink’s regulatory wins, and its high‑stakes IPO planning—to remain central in LP meetings, VC memos, and founder conversations. The combination of active product development and a record‑setting prospective IPO makes SpaceX both a symbol and a driver of the new funding landscape: one where deep tech, infrastructure, and space are no longer fringe, but core to how venture capital imagines the next generation of outsized outcomes.spacex+5

- https://www.reuters.com/business/spacex-pursue-2026-ipo-raising-above-30-billion-bloomberg-news-reports-2025-12-09/

- https://parsers.substack.com/p/weekly-funding-rounds-statistics-38e

- https://www.sidekickmoney.com/market-pulse/spacex-pursues-a-1-5-trillion-ipo-meta-quietly-pivots-from-open-source-ai-fca-plans-pro-growth-changes-in-2026

- https://news.crunchbase.com/venture/biggest-funding-rounds-xai-parabilis-medicines-soley-therapeutics/

- https://www.bloomberg.com/news/newsletters/2025-12-17/spacex-ipo-how-it-could-give-the-whole-industry-a-boost

- https://www.wellington.com/en/insights/venture-capital-outlook

- https://www.morningstar.com/news/business-wire/20260113190645/healthcare-venture-markets-regain-momentum-as-capital-returns-according-to-hsbc-innovation-banking

- https://www.saastr.com/20vc-x-saastr-is-back-spacexs-1-5-trillion-ipo-lightspeeds-9-billion-mega-raise-and-why-all-these-late-stage-giants-staying-private-is-the-greatest-gift-to-venture-in-our-lifetimes/

- https://www.cnbc.com/2026/01/09/andreessen-horowitz-raises-15-billion-big-in-infrastructure-defense.html

- https://intellizence.com/insights/startup-funding/the-weeks-5-biggest-funding-rounds-signal-strong-investor-conviction-in-ai-biotech-infrastructure/

- https://www.vntr.vc/media/the-15-trillion-question-what-spacexs-historic-ipo-means-for-venture-backed-exit-markets

- https://www.pcmag.com/news/big-win-for-spacex-as-fcc-clears-it-to-upgrade-starlink-with-gigabit-speeds

- https://www.spacex.com/vehicles/starship

- https://www.spacex.com/updates

- https://www.ien.com/product-development/article/22958075/superheavylift-rockets-like-spacexs-starship-could-transform-astronomy-make-space-telescopes-cheaper

- https://www.ainvest.com/news/spacex-ipo-strategy-implications-long-term-growth-evaluating-strategic-financial-pathways-2512/

- https://finance.yahoo.com/news/spacex-record-ipo-plan-pushes-201920851.html

- https://news.satnews.com/2025/12/08/musks-next-step-could-be-expensive/

- https://www.reuters.com/business/aerospace-defense/musks-mars-mission-adds-risk-red-hot-spacex-ipo-2025-12-12/

- https://www.reddit.com/r/spacex/comments/1kvucce/spacex_company_presentation_may_2025_discussion/

- https://aviationweek.com/space/operations-safety/spacex-plans-starlink-orbital-changes