Below is a detailed report on Anthropic, covering its product line, competitors, history, funding, strategic investors, key partnerships, management, public controversies, lawsuits, and a thorough SWOT analysis. This synthesis is based on recent market data, public filings, company statements, and press coverage spanning late 2025.wikipedia+8

Anthropic: A 2025 Deep-Dive Report

Introduction

Anthropic PBC is an American artificial intelligence (AI) startup, founded in 2021 and now the fourth most valuable private company in the world, valued at $183 billion as of September 2025. Anthropic focuses on AI safety, reliability, and alignment, setting industry standards with its flagship large language model (LLM) family, Claude.anthropic+1

Corporate History and Purpose

Anthropic was founded by seven former OpenAI employees, notably siblings Dario Amodei and Daniela Amodei, who serve as CEO and President, respectively. The company launched with a vision to build safer, more interpretable AI systems and became a Delaware public-benefit corporation, allowing it to balance financial interests with its mission for the long-term benefit of humanity.wikipedia+1

Anthropic’s research and product development started with a deep focus on AI safety and alignment, rapidly evolving from the private release of early Claude models to integrating safety mechanisms like Constitutional AI—formulated to align model behavior with human values and legal precedent.anthropic+1

Product Portfolio

Claude Language Model Series:

The Claude family—including Claude, Claude Instant, Claude 2, Claude 3 Opus/Sonnet/Haiku, and the latest Claude 4—has served both enterprise and consumer markets. Anthropic pioneered innovations in interpretability, benchmark performance, image input, and real-time web search capabilities. Key features of cutting-edge releases include:wikipedia

-

Constitutional AI: Rule-based alignment safeguarding outputs.

-

Multimodal input: Text and images.

-

Coding assistance: IDE integration (VS Code, JetBrains), GitHub Actions.

-

Artifacts: Generation of interactive web content and real-time chart interpretation.

-

API expansions: Model Context Protocol (MCP) and native access in leading platforms.

Enterprise and Government Solutions:

Anthropic launched enterprise plans (Claude Team), specialized sector models (Claude Gov), and formal advisory boards for government and higher-education clients. U.S. defense contracts and secure deployments for intelligence agencies have cemented Anthropic’s dual role in public and private sectors.research.contrary+2

Key Partnerships

-

Amazon: Anthropic uses AWS for cloud infrastructure, benefiting from over $8 billion in funding and exclusive access to high-performance chips.anthropic+2

-

Google: Anthropic leverages up to 1 million custom TPUs, with Google investing $2 billion. Anthropic offers enhanced performance and reliability for Claude customers via Google’s cloud.anthropic+1

-

Databricks: Native integration of Claude models into the Databricks Data Intelligence Platform since 2025, allowing thousands of companies to deploy advanced agents easily.research.contrary

-

Salesforce: Partnership enhances trusted AI deployment for regulated industries.investor.salesforce

-

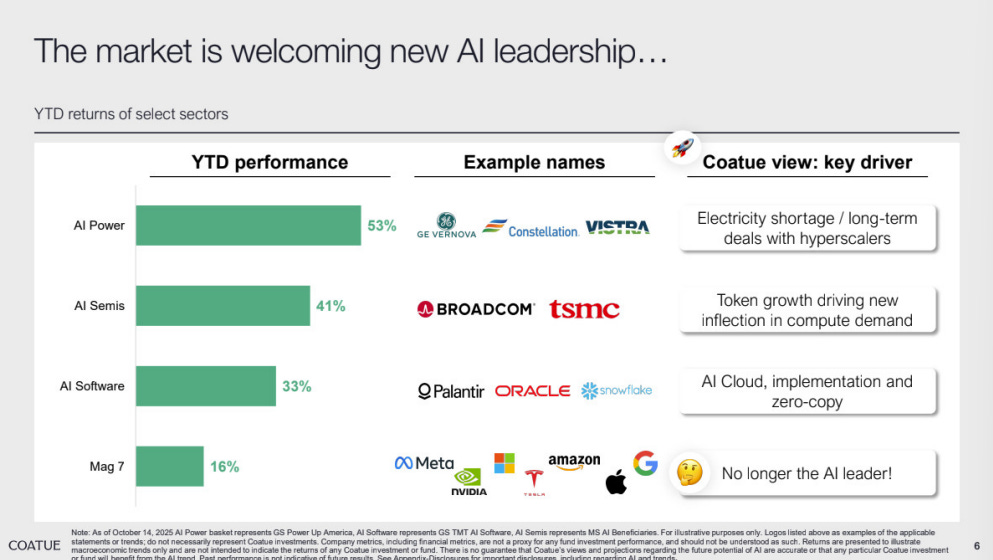

Palantir: Provides Claude to U.S. intelligence and defense, including usage in classified environments.research.contrary+1

Funding Rounds and Strategic Investors

Anthropic is renowned for raising mega-rounds:

-

April 2022: $580M, led by FTX.

-

March 2025: Series E—$3.5B, $61.5B valuation (Lightspeed, Fidelity, Salesforce Ventures, Menlo Ventures, Bessemer, Jane Street, Cisco Investments, General Catalyst).

-

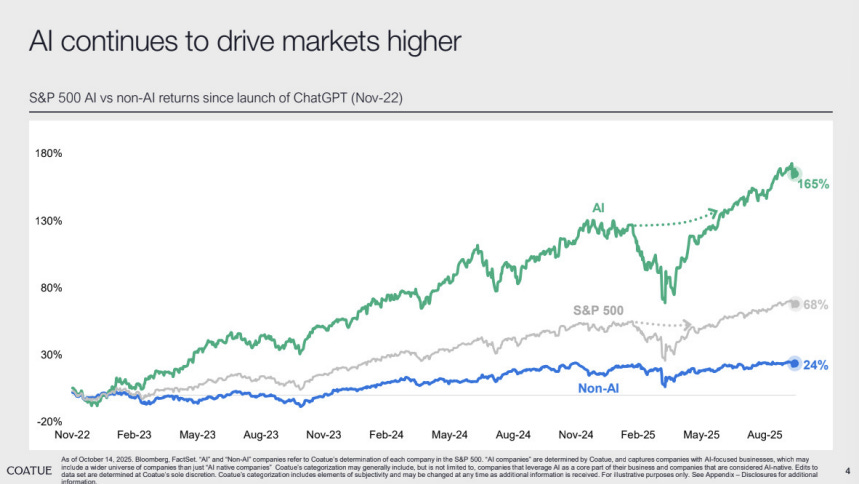

September 2025: Series F—$13B at a $183B valuation, led by Iconiq, Fidelity, and Lightspeed. Major participants: Qatar Investment Authority, Blackstone, Coatue, Altimeter, Baillie Gifford, BlackRock, TPG, T. Rowe Price, Ontario Teachers’ Pension Plan, and Insight Partners.linkedin+4

Investors see this massive capital influx as a bet on Anthropic’s exponential customer demand and technical innovation, with projected annual recurring revenue (ARR) expected to hit $9B by year-end.research.contrary

Management and Talent Movement

Executive Team:

-

Dario Amodei: CEO, co-founder.

-

Daniela Amodei: President, co-founder.

-

Mike Krieger: Chief Product Officer.

-

Jack Clark: Head of Policy, co-founder.

-

Tom Brown: Head of Core Resources, co-founder.

-

Krishna Rao: CFO.

-

Jan Leike: Co-lead, Alignment Science Team.

-

Chris Ciauri: Managing Director, International.etcjournal+3

Anthropic is characterized by aggressive hiring from top AI labs and Silicon Valley, including talent from OpenAI, Google, and NASA. Turnover remains a factor—high-profile departures and hires reflect a rapid cycle typical of frontier AI labs.etcjournal+1

Competitive Landscape

Anthropic’s primary competitors include:

-

OpenAI ChatGPT: Versatile, industry-leading conversational AI.

-

Google Bard: Integrated with Google services, real-time search.

-

Microsoft Copilot: Deeply embedded in Microsoft 365, productivity suite.

-

Cohere AI: Custom NLP models for enterprises.

-

IBM Watson, Hugging Face: Robust enterprise AI platforms, often emphasizing governance and flexibility.byteplus+1

Anthropic distinguishes itself through emphasis on safety, public benefit governance, and advanced model interpretability. Nonetheless, close performance benchmarks and investment rivalries with OpenAI and Google drive relentless innovation and market competition.joinsecret+1

Financial and Market Performance

Anthropic estimates annual recurring revenue (ARR) at $5B as of October 2025, with a trajectory to reach $9B by year-end. Enterprise API adoption drives 70-75% of revenue streams, supplemented by consumer subscriptions and premium support plans.research.contrary

Negative Publicity and Legal Challenges

1. Copyright Lawsuits

-

Book Authors Settlement: In September 2025, Anthropic agreed to pay $1.5 billion to settle a class-action suit filed by authors who alleged the use of pirated book copies for chatbot training. The settlement—$3,000/book for ~500,000 titles—is the largest copyright resolution in U.S. history. The case established that training on copyrighted materials was legal if done with legitimately sourced copies, but not if using pirated versions.pbs+2

2. Music Publishers Lawsuit

-

Filed October 2023 by Universal, Concord, ABKCO, and others alleging copyright infringement via song lyrics used in Claude training. Plaintiffs sought damages up to $150,000 per work.wikipedia

3. Data Scraping Litigation

-

Reddit Case: In June 2025, Reddit sued Anthropic for alleged violations of its user agreement in scraping data for model training.wikipedia

4. Geopolitical Restrictions

-

As of September 2025, Anthropic has ceased sales to organizations majority-owned by Chinese, Russian, Iranian, or North Korean entities, citing national security risks.wikipedia

5. Security Concerns

-

Anthropic’s transparency about model vulnerabilities—including documented incidents of Claude’s use in basic malware development—reflect broader concerns about dual-use AI risks.red.anthropic

SWOT Analysis

Strengths:

-

Industry-leading AI safety and alignment research.

-

Massive capital reserves and strategic investments from Amazon, Google, and leading VCs.

-

Strong partnerships in both defense and enterprise sectors.anthropic+2

-

Rapid revenue growth, ambitious product roadmaps.

Weaknesses:

-

Ongoing legal risk from copyright litigation, especially content sourcing for training.

-

Talent churn and competitive pressure for top researchers.etcjournal

-

High dependency on strategic partnerships for infrastructure and compute.

-

Geopolitical exposure (Chinese, Russian, Iranian/North Korean market restrictions).

Opportunities:

-

Expansion in government, military, and regulated industries.

-

Further integration in cloud and data platforms.

-

Leading development of new safety and interpretability protocols.

-

Scale-up of multimodal and tool-integrated AI applications.research.contrary

Threats:

-

Intensifying competition from OpenAI, Google, Microsoft, and Cohere.

-

Risk of adverse regulatory action, particularly around copyright and user privacy.

-

Increasing cost of compute and security compliance as models scale.

-

Potential for reputational damage from high-profile legal settlements.npr+2

Conclusion

Anthropic occupies a pivotal position at the intersection of technical innovation, responsible AI governance, and the global capital markets. Its massive fundraising rounds underscore investor faith in its vision, while strategic partnerships offer infrastructure scale and market reach. With the industry’s largest copyright settlement behind it, Anthropic’s next challenge is to adapt to maturing regulatory landscapes and keep pace with fierce product competition.

Recent efforts to tighten geopolitical restrictions, enhance model safety, and extend enterprise offerings mark the company’s transition from upstart challenger to foundational AI vendor for governments and Fortune 500s. For investors and users alike, Anthropic’s journey through 2025 sets the tone for what’s possible—and what’s challenging—in safe, scalable, and ethical AI deployment.anthropic+7

Sources spanning all cited records, including Wikipedia, Anthropic’s official statements, mainstream news coverage, and in-depth funding, product, legal, and partnership reporting as of October 2025.