The 400-Year Bubble Study: Inside Coatue’s AI Report

From https://www.thevccorner.com/p/coatue-ai-report-18-charts

Coatue just published one of the most talked-about reports in tech and finance this year.

After studying 30 bubbles over 400 years, Philippe Laffont’s $54B hedge fund concluded that AI isn’t a bubble, but an early industrial revolution.

Below are 18 key slides that capture their full argument. Each one reveals a different angle on how AI is reshaping markets, productivity, and investment logic:

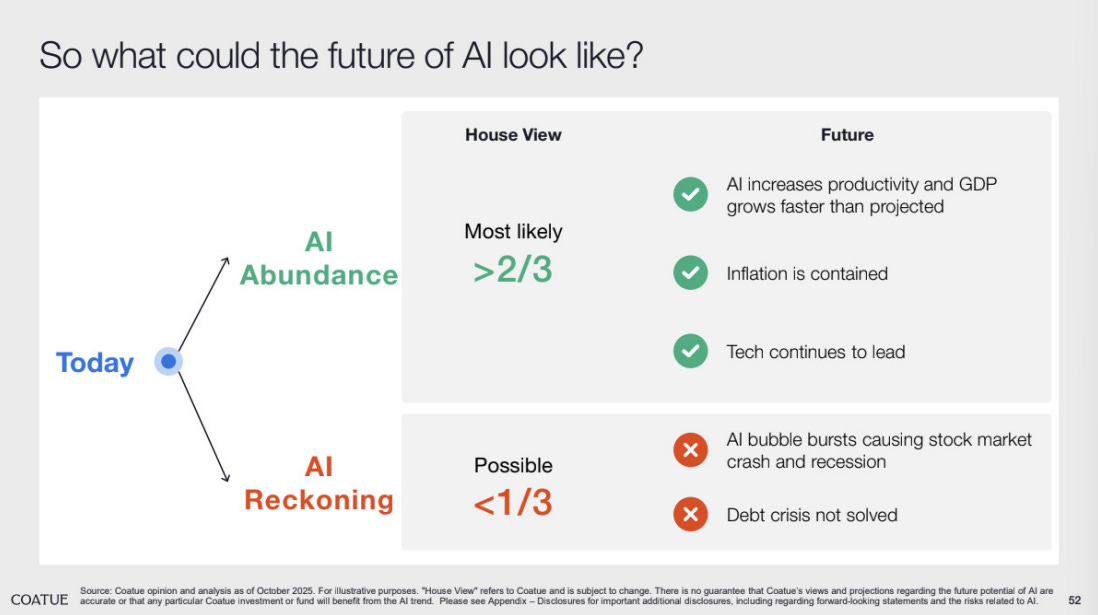

1. AI continues to drive markets higher

AI stocks have outperformed the S&P 500 by more than 160% since ChatGPT’s launch.

Coatue calls this “the AI premium” — still justified by fundamentals.

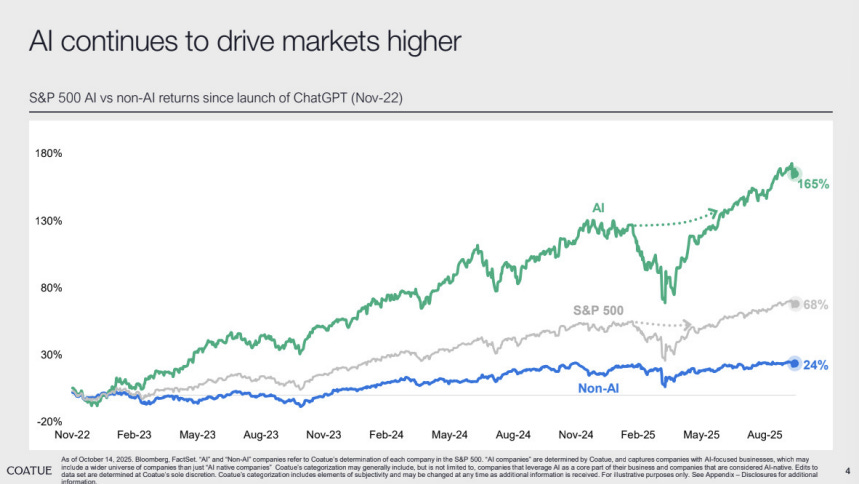

2. New AI leadership is emerging

Energy, semiconductors, and cloud infrastructure are leading the returns.

“AI power” has replaced “AI software” as the market’s growth engine.

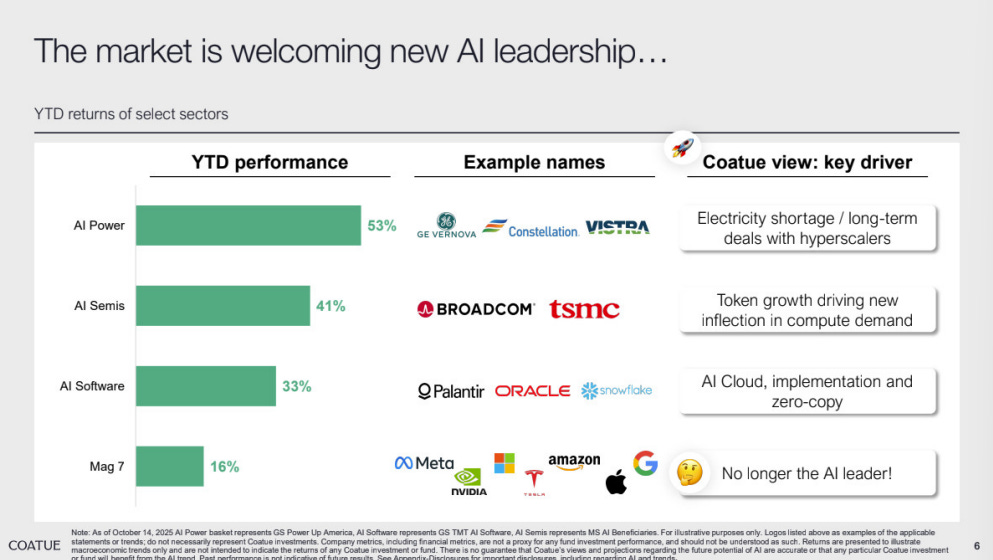

3. Inflation expectations are moderating

Coatue believes the macro backdrop remains supportive.

Inflation expectations for 2025 have stabilized near 3%, easing pressure on rates.

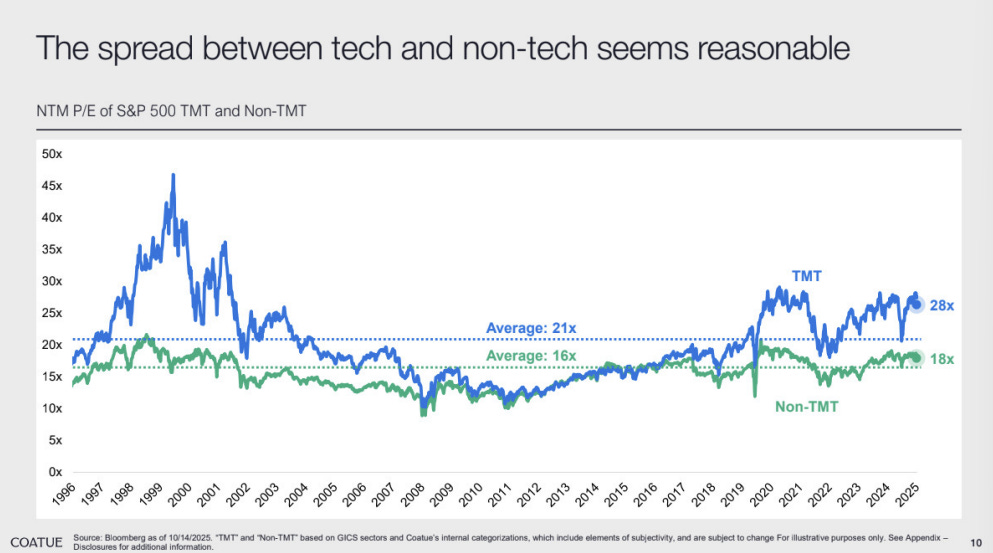

4. Tech vs non-tech: valuation spread is rational

The gap between tech and non-tech P/E multiples is wide, but within historical norms.

Unlike 1999, tech’s profits justify the premium.

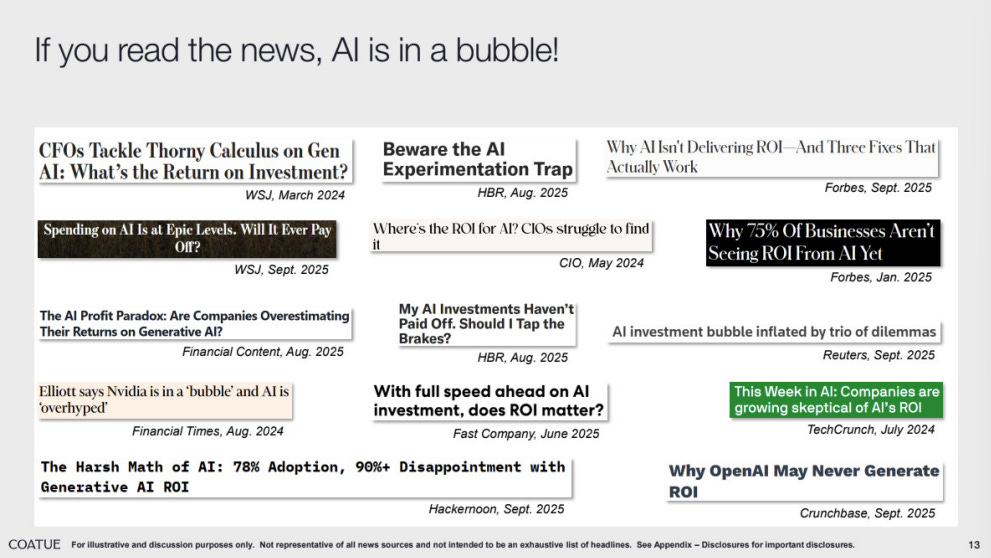

5. Media says “AI is a bubble” — Coatue disagrees

Headlines warn of hype.

Coatue’s view: adoption is real, ROI is measurable, and corporate demand is accelerating.

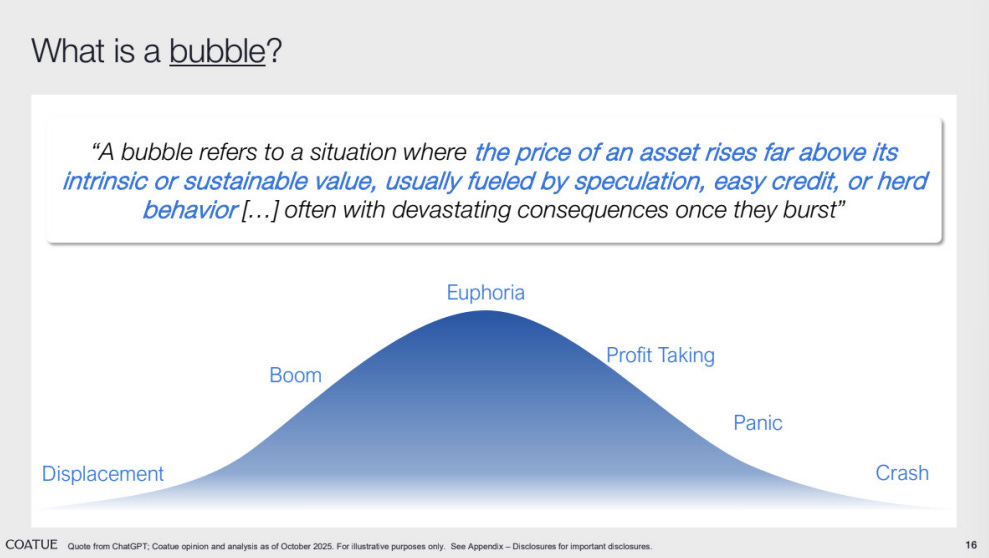

6. What a bubble actually looks like

Displacement → Boom → Euphoria → Profit taking → Panic → Crash.

Coatue’s takeaway: AI is still in the displacement phase — not euphoria.

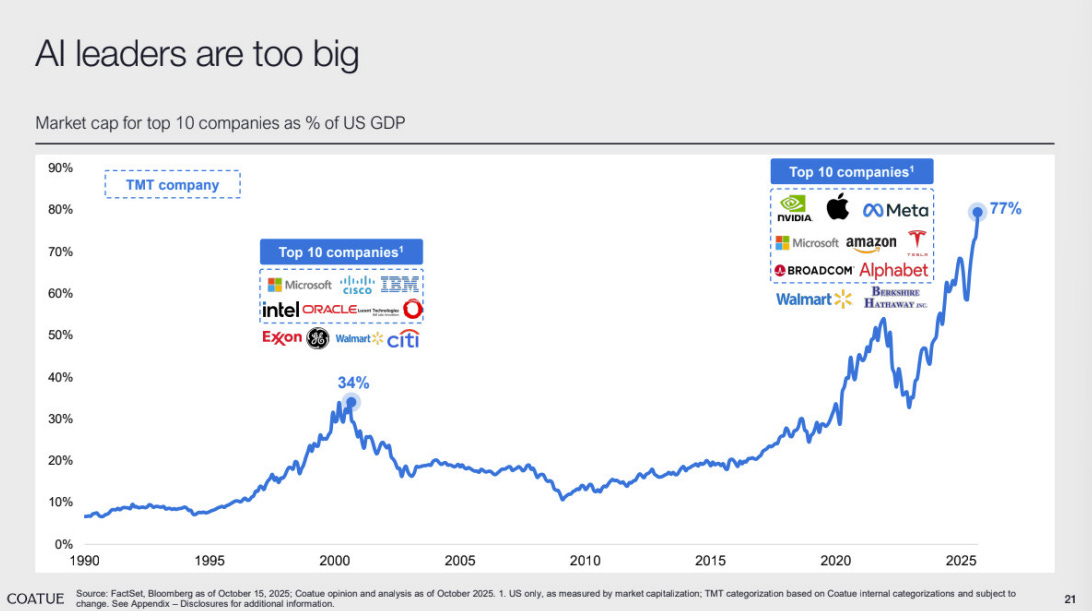

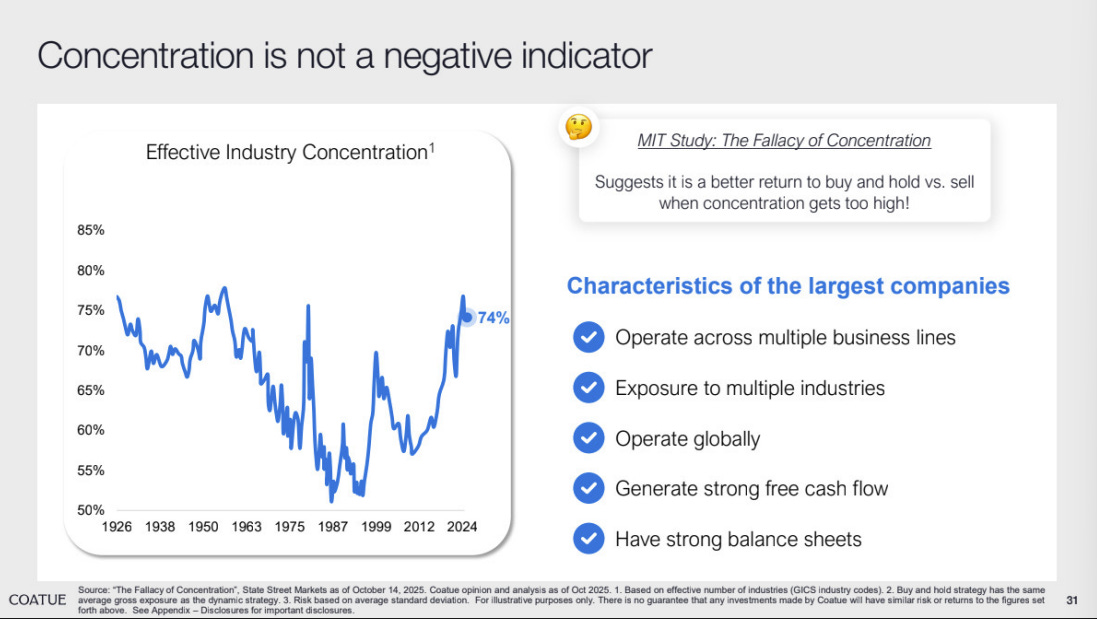

7. Are AI leaders too big?

But these giants are profitable, global, and diversified.

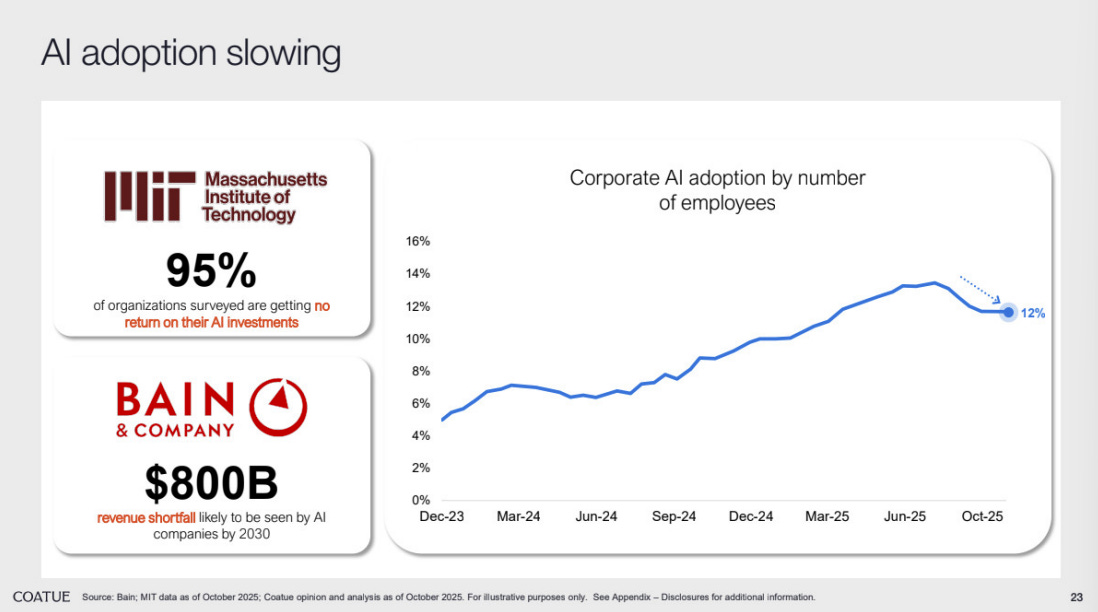

8. AI adoption is slowing slightly

Coatue notes a short-term plateau before the next wave of enterprise integration.

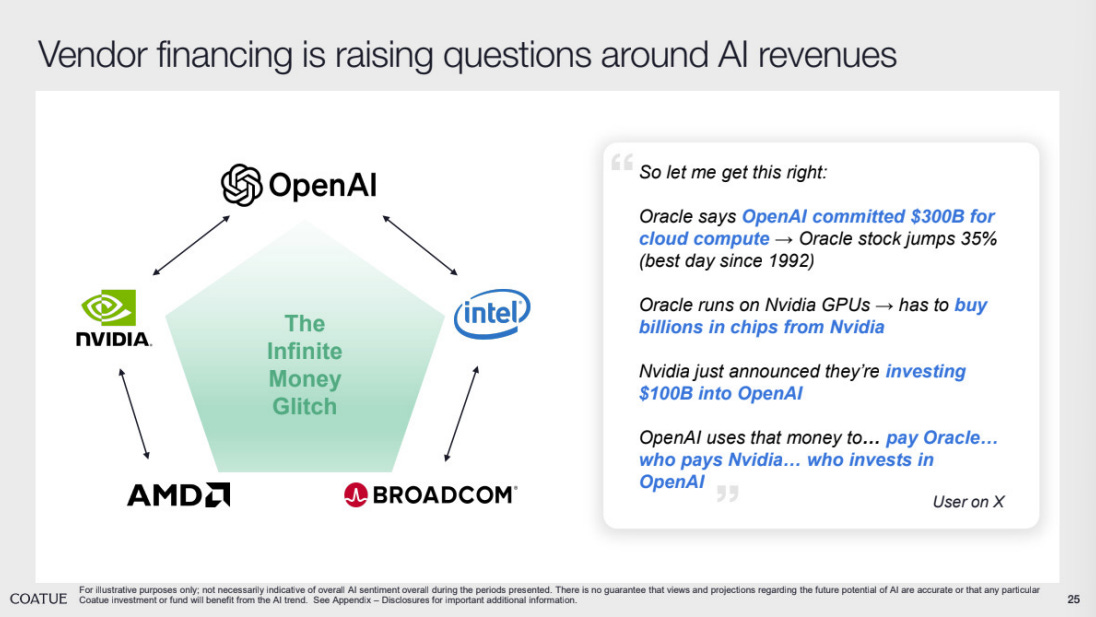

9. Vendor financing: the “infinite money loop”

Coatue calls it “the infinite money glitch” — sustainable only if ROI keeps improving.

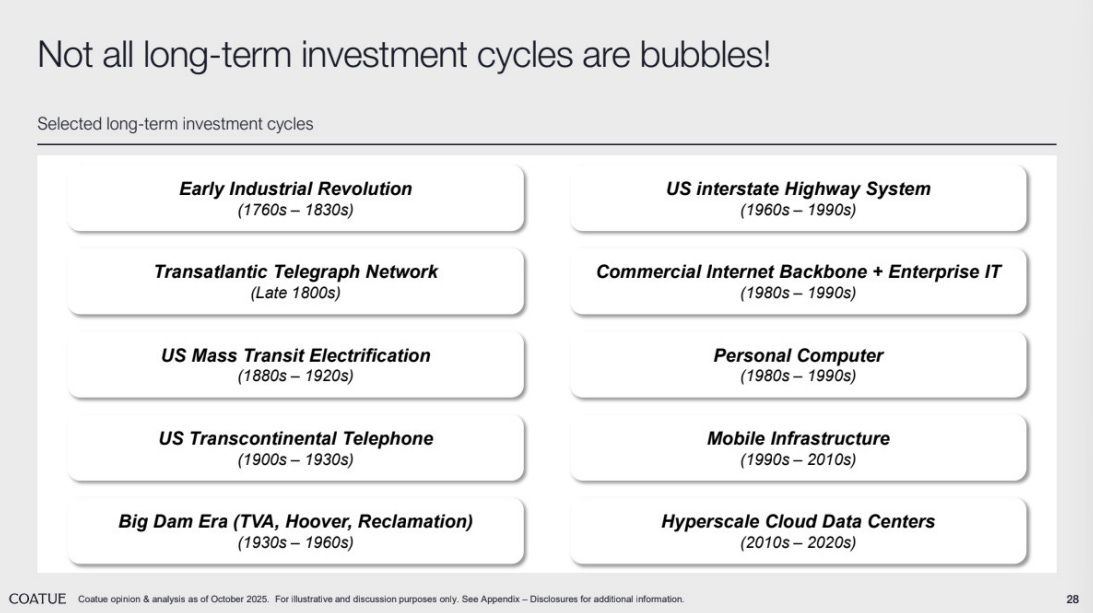

10. Not all long-term cycles are bubbles

AI, they argue, fits that pattern.

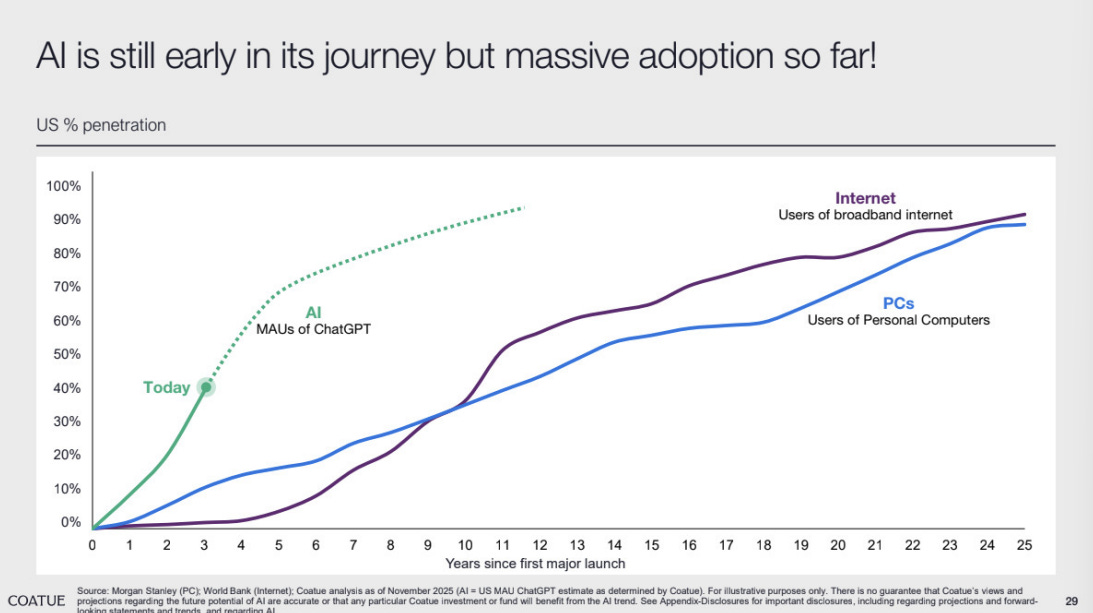

11. AI is early — but adoption is massive

Coatue says the adoption curve is still steep.

12. Market concentration isn’t a red flag

AI’s largest players have strong balance sheets and multiple revenue lines.

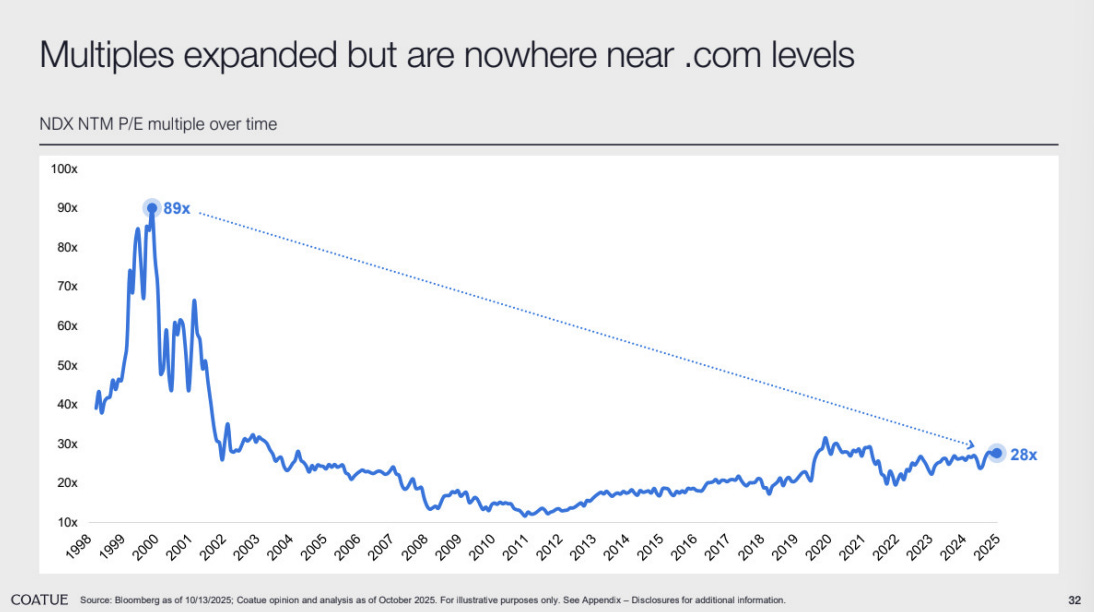

13. Multiples expanded, but far below dot-com levels

Today’s multiple: roughly 28x — high, but grounded in earnings.

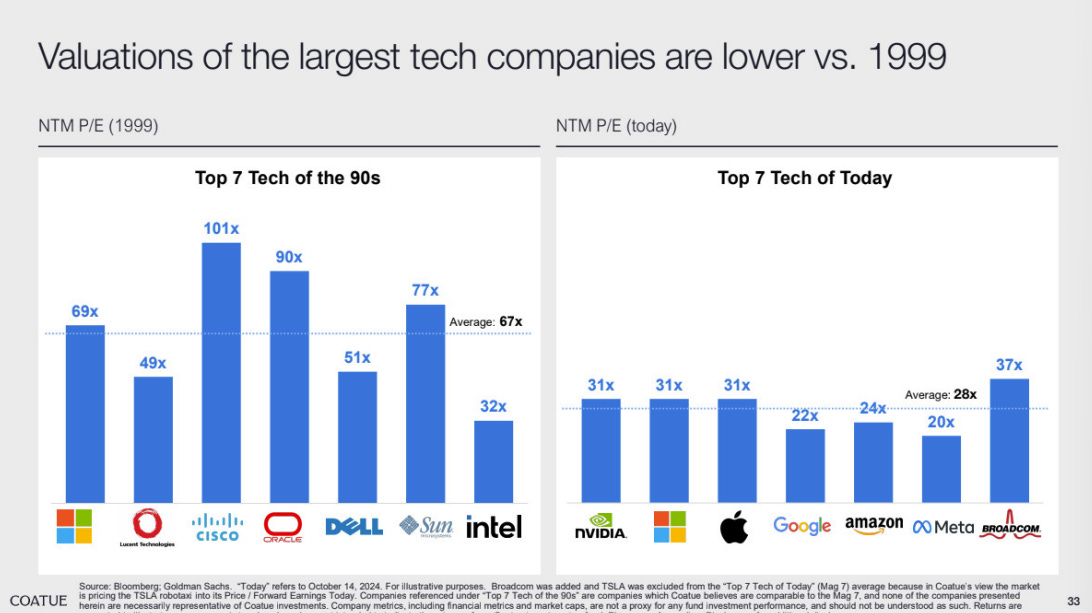

14. 1999 vs 2025: valuations are healthier

In 2025, it’s closer to 28x — with stronger balance sheets and cash flow.

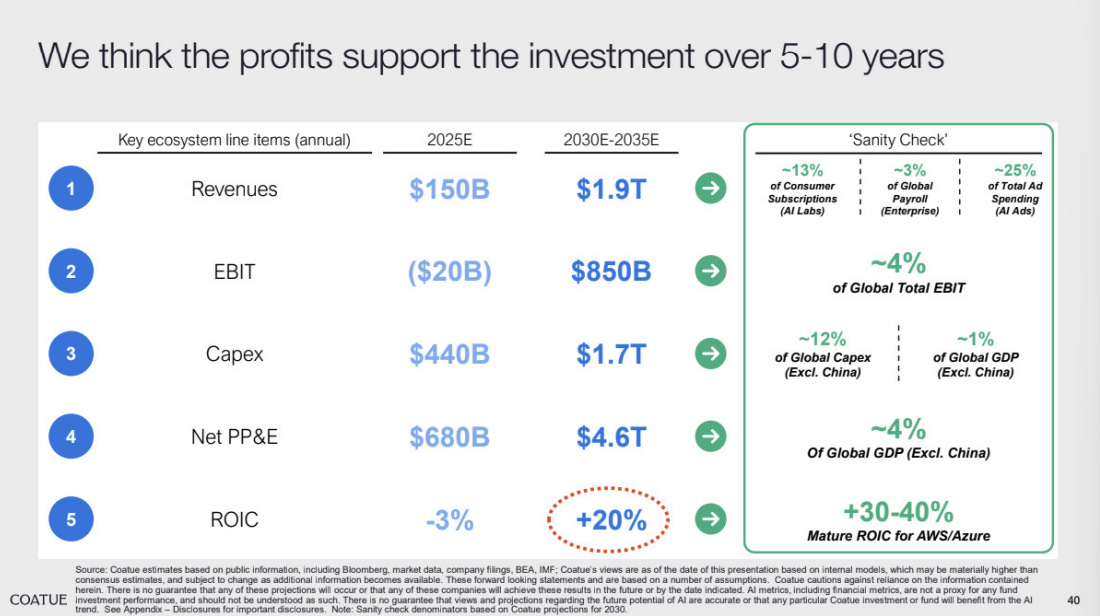

15. Profits justify the investment

Coatue expects margins to compound as adoption scales.

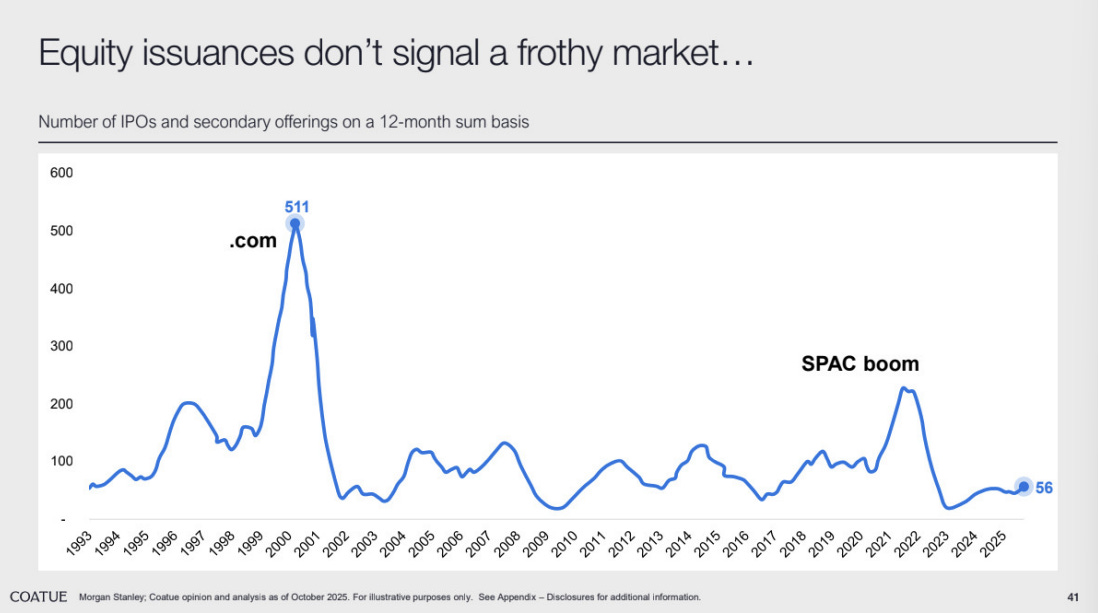

16. IPO activity is muted

The .com boom saw 500+ IPOs a year; today, fewer than 60.

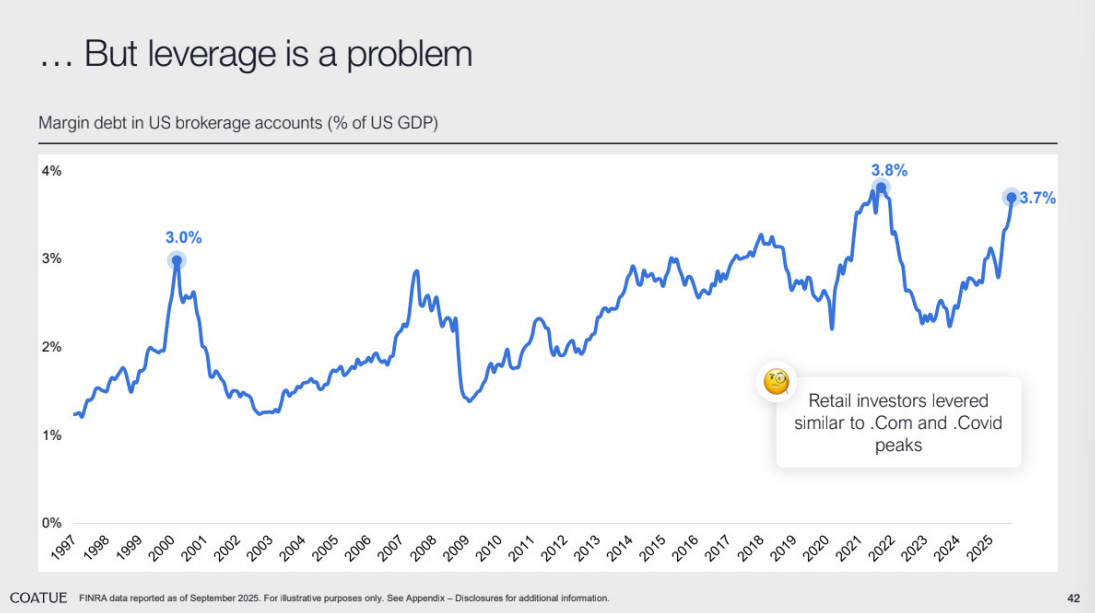

17. Leverage is creeping back

Coatue flags this as one of the few genuine risks in the system.

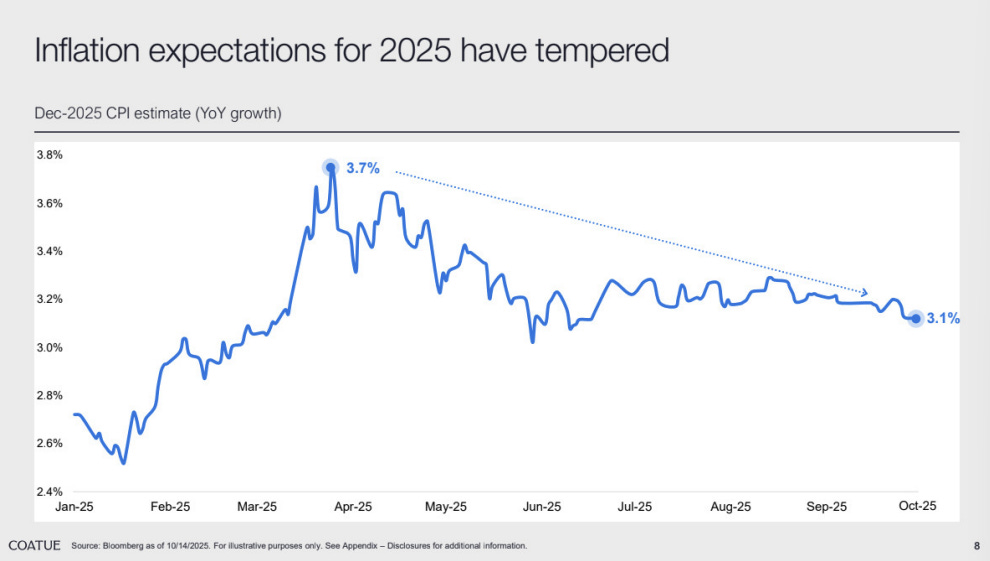

18. The two futures of AI

- AI Abundance (probability >66%): Productivity accelerates, inflation stays low, tech keeps leading.

- AI Reckoning (<33%): Bubble pops, recession follows, credit stress rises.

Coatue is betting on the first.