Healthtech 2024: Voices in My Head…

From Michael Greely – On the Flying Bridge

What is going on? The stock market just hit an all-time high and yet nearly everywhere one looks, there are flashing warning signs. A review of the 2023 investment activity suggests there will be continued challenges in the capital markets. Clearly, the bulls look to the $8.8 trillion in money market funds and conclude that as interest rates continue to fall much of that capital will rotate back into risk assets. Today, U.S. household net worth is over $152 trillion. But it still feels so schizophrenic.

Data: FactSet. Chart: Axios Visuals

But first some of the troubling indicators not to be ignored, to say nothing of the numerous global hot spots now. The World Bank recently concluded that the global economy just suffered its worst 5-year stretch over the last three decades, and now forecasts only 2.4% economic growth in 2024. The analysis concludes that the 24 lowest income earning countries are at “crisis levels,” which will acutely exacerbate global immigration issues. The “low/middle” income countries have economic activity that is at least 5% below pre-pandemic levels.

The Federal Reserve incurred a 2023 operating loss of $114.3 billion, its largest in its 109-year history. Moody’s noted that global bond defaults spiked to a trailing twelve-month average of 4.8%, which does not even start to account for the $117 billion of U.S. commercial real estate debt that must be refinanced in 2024 – perhaps the greatest near-term potential systemic contagion. U.S. office vacancy rate just touched 19.6%, the highest level since the late 1960s when Moody’s started to track these data.

The London Stock Exchange concluded that the global M&A activity of $2.9 trillion of 2023 transaction volume was the first time in ten years that activity fell below $3.0 trillion. This level was 17% below 2022 (6% decline in the U.S.), with financial sponsor activity down by nearly 30%.

Not surprisingly, these conditions directly impacted investment activity in the private equity and venture capital sectors in 2023, which was markedly down across the board. Notwithstanding that there is an estimated $2.6 trillion in dry powder in private funds according to S&P Global Market Intelligence, a fundamental issue was the lack of exits which was less than 7.6% of total assets under management in 2023, the lowest level yet.

Source: Blackrock 2024 Private Markets Outlook.

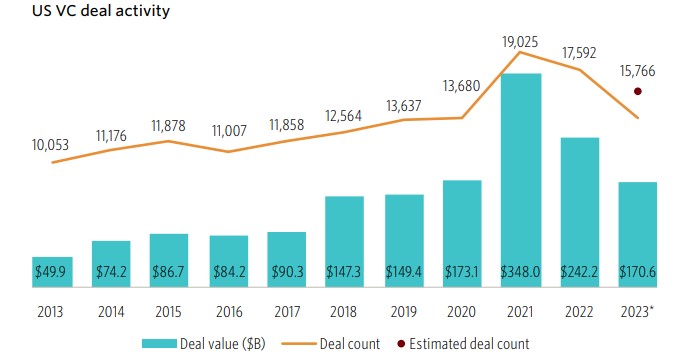

The venture capital investment activity in 2023 declined sharply to $170.6 billion in 15,766 companies (average round size of $10.8 million), as compared to $242.2 billion in 17,592 (average round size of $13.8 million) in 2021, underscoring the significant retrenchment. Notwithstanding that, 2023 still looks to be the third highest year on record and clearly appears to be putting the industry back on long-term historical trend. Notably, though, approximately 10% of the 2023 investment was in just two AI companies (OpenAI, Anthropic); an estimated 33% of all venture capital investment last year was in AI companies. Additionally, Pitchbook estimated that the number of active venture firms (through 3Q23) declined by 38%, suggesting that there is continued consolidation of both companies that receive venture capital and of the firms themselves.

Source: Pitchbook/National Venture Capital Association.

Obviously, geopolitical issues materially influence investor sentiment in 2023. According to a recent analysis by the Financial Times, globally the backlog of all defense industry companies amounted to $777.6 billion in 2022, which has only significantly increased given issues in the Middle East and is nearly 3x the $248.4 billion of venture capital invested globally. A very sad commentary.

Pitchbook estimates that there are now 54k venture-backed U.S. companies with over 4k having raised their first round of capital in 2023. While there were declines across all stages, the early-stage category (23% of total) dropped significantly and is now below pre-pandemic levels. The average round size dropped from $20.0 million to $15.4 million and average pre-money valuations fell from $122.4 million to $82.0 million from 2022 to 2023, respectively. Average late-stage pre-money valuations only dropped from $258.3 million in 2022 to $240.7 million last year.

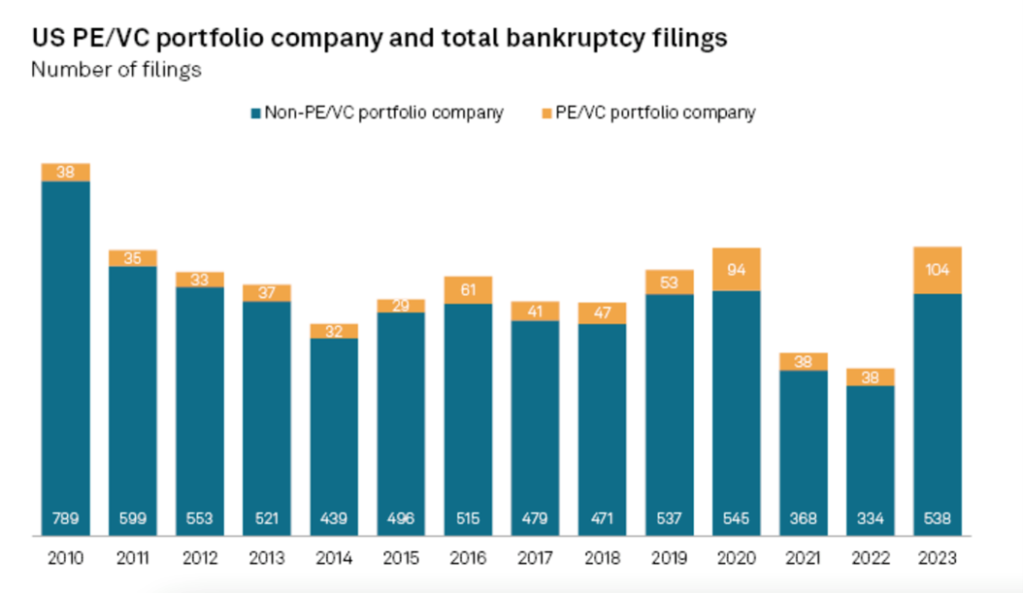

Two things make the venture capital industry go round: massive success stories and limited losses, which there will always be in this risky corner of the private capital markets. The overall exit activity was, quite frankly, dismal. There was $61.5 billion of exits across 1,129 transactions, which is the lowest level since 2010 and nowhere near the $796.8 billion in 2021. The sharp rise in interest rates over the last two years dramatically curtailed the number of new unicorns according to an interesting longitudinal study by Cowboy Ventures and led to a spike in bankruptcies of private capital backed companies. According to CB Insights, globally there are now 1,224 unicorns valued at just under $3.8 trillion; approximately 720 of which are based in the U.S.

Source: Cowboy Ventures.

There is consistently a lag between public and private market valuations, and while much of the exit activity is labeled “terms not disclosed,” there is heightened anxiety that 2024 will see more pain revealed as venture-backed companies simply run out of money. There is also a shadow level of investment activity that goes unreported as investor syndicates provide modest levels of support (1-3 quarters) to bridge to an exit. Arguably, 4Q23 was littered with many such financings that may have only delayed the inevitable. Research by S&P Global Market Intelligence showed a spike in bankruptcy filings in 2023 to 104 of privately financed portfolio companies which was nearly 3x the 2022 level and the greatest volume ever recorded.

Source: S&P Global Market Intelligence

Not surprisingly then, the level of initial public offerings over the last two years has been uninspiring, and largely accounts for how backed up the system is now. According to the same S&P Global Market Intelligence report, there were 370 IPOs launched globally in 4Q23 (only 26 in the U.S.) which was markedly down from the 921 in the same quarter two years ago. For the year, there were 1,429 IPOs globally.

Source: S&P Global Market Intelligence

These crosscurrents net out to possibly troubling signs for entrepreneurs as 2024 starts to unfold. Notwithstanding falling interest rates, the lack of exit liquidity has made fundraising harder for venture capital firms. In total, there were 474 funds which raised $66.9 billion in 2023, which were both down from the 1,340 funds and $172.8 billion in 2022 (which was essentially the same activity in 2021). Given the extraordinary level of investment activity in 2021 – 2022, the pace of expected follow-on rounds starting in mid-2023 likely has moved the venture capital industry into a position of being “undersupplied.” This has been exacerbated by the pull-back of cross-over non-traditional investors in venture capital deals, many of which drove the frothy large late-stage rounds of the past few years.

Source: Pitchbook.

Given this transition period, an interesting debate has taken hold about the optimal size of venture funds, which is somewhat determined by expected exit valuations for successful investments. Over the last ten years of Pitchbook data, the average exit valuation across nearly 14k reported transactions was approximately $150 million, while a recent analysis by Sante Ventures concluded that most exited venture-backed portfolio companies are at valuations below $400 million. Last year the average exit valuation was $54 million, while the highwater mark of $400 million was in 2021.

A review of 40 years’ worth of Pitchbook returns data concluded that outsized returns (greater than 2.5x of paid-in capital) tend to accrue to mid-sized funds, and yet the industry continues to be an arms race to raise ever larger funds, further concentrating the number of investors in larger firms. Successful funds tend to correlate with greater ownership stakes in the underlying portfolio companies, and that while companies that raise large “mega rounds” (greater than $100 million) tend to have higher likelihood for an IPO, in times when that path is closed, generating venture returns can be quite challenging. Nearly half of all venture capital commitments through 3Q23 were to funds greater than $500 million in size.

Source: Pitchbook.

The digital health sector was not insulated from the downdraft in activity in 2023. According to Rock Health, overall investment activity was $10.7 billion in 492 companies, down from $15.3 billion and 577 companies in 2022 and nearly one-third of the $29.2 billion in 2021. And yet, 2023 was well ahead of the ten-year trendline and represented a relatively robust level of activity given the environment.

More troubling has been the reduction in funding for healthcare technology unicorns, given the imperative to be at least cash flow positive, if not generating free cash flow and self-funding. According to Pitchbook, over the past three years $18.1 billion has been invested in such companies, but only $1.2 billion of that amount was in 2023. Pitchbook tallies 70 venture-backed active healthcare technology unicorns which have raised $31 billion in aggregate and are currently valued at $173 billion, representing a pipeline of possible IPO candidates when that market re-opens.

In this “Efficiency Phase” of this financing cycle, when the healthcare technology sector is likely to consolidate around emerging winners that have developed products that drive near-term hard ROIs, the financing dynamics are very complicated. Rock Health reported that 44% of rounds in 2023 were “unlabeled,” suggesting a significant level of defensive insider bridge financing. M&A activity declined by 23% in 2023 from 2022 with 146 announced transactions, while there were literally zero IPOs in the sector (and only one in the past 24 months).

More broadly, Refinitiv reported that there was $140 billion of private equity investments in the healthcare sector over the past five years, although Pitchbook determined that private equity activity in 2023 declined by 60%. There was also a record number of “large” bankruptcies last year in healthcare, up 5x from 2022, according to BankruptcyData.com.

Notwithstanding continued funding headwinds this year in the healthcare technology sector, the needs have never been as evident or acute. The Institute for Health Metrics and Evaluation’s Global Burden of Disease study released recently determined that the proportion of life that is characterized as being “in good health” declined from 85.8% to 83.6% over the last 30 years, likely equating to one year lost. Healthcare technology is the great democratizing force to bring appropriate and timely care to all.

Source: James Bailey (2019 data).

Interestingly, a review of healthcare spending as a percent of GDP shows an extraordinary variance by state. Certain states, such as West Virginia, spend nearly 25% of its GDP on healthcare services, and therefore, could be important geographies that should realize the greatest benefits through concerted investment in healthcare technologies to reduce costs, lower barriers to care, and presumably improve outcomes and address issues of equity.

Obviously, government policies also matter. The Kaiser Family Foundation projects that between 8 – 24 million people will lose Medicaid coverage this year, which would likely upend many of these state’s budgets.

Given severe downward pressure on healthcare companies due to labor issues, pressure on reimbursements and payments, and financing environment, the recent investments in technology are expected to drive fundamental improvements in operating cost structures. Greater automation is expected to reduce operating complexity over time.

The recent advancements in AI capabilities, including improvements that mimic human reasoning, cognition, and task completion, have created compelling investment opportunities. These advances are manifest in the physical world through intelligent hardware platforms for novel devices such as robots that address problems outside the digital world. New AI-powered image generators will provide photos, charts, and video content seamlessly into clinical and administrative workflows.

Technology advances today are occurring more rapidly than at any point in history. Whenever there have been such dramatic transitions in technology platform shifts, existing enterprises become more efficient and competitive, but these shifts have also introduced new capabilities and product offerings previously unimaginable.

Source: Silicon Valley Bank.

While the prospects for investment returns in the healthcare technology sector in the short term are confusing, the overall Leerink Healthtech index is currently trading at 3.1x 2024 revenues with an overall market capitalization of $111 billion. The Digital Health subsector is trading at 3.4x forward revenues, representing nearly 70% of the overall valuation, and is trading at a heady 19.9x forward EBITDA multiple. According to the Wall Street Journal tracker of leading indices in 2023, cocoa was on top of the leader board with a 61.4% return. Next up was the S&P500 Information Technology index at 56.4%, while the Argentine peso was dead last at (78.1)%.

This year may be tricky for Argentinian digital health companies looking to go public…

Checkout Venture Capital Cross for Disruptive Paradigm Shift deals

Discover more from Blog VC Cross

Subscribe to get the latest posts sent to your email.